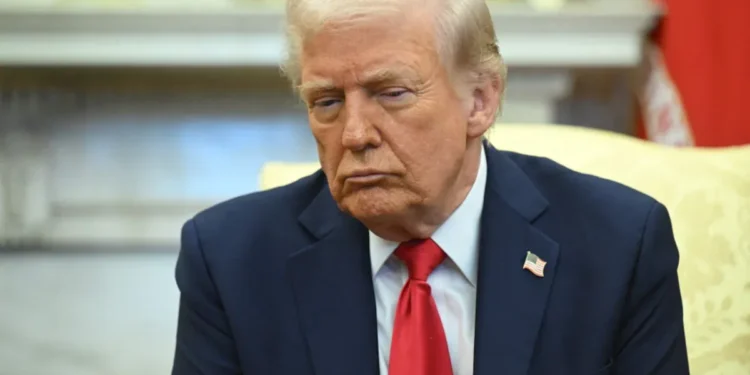

Former U.S. President Donald Trump has proposed an ambitious plan to sell U.S. residency to billionaires and wealthy individuals through a “gold card” visa, costing $5 million per applicant. The initiative, designed to raise funds to offset the federal deficit, is projected to generate as much as $5 trillion if a million such visas are sold. However, the response from the global billionaire community has been lukewarm at best. A recent survey by Forbes reveals that most of the world’s wealthiest individuals have little to no interest in purchasing this exclusive residency offer.

The Gold Card Visa: What’s on Offer?

Trump’s proposal introduces a new form of U.S. residency targeted specifically at high-net-worth individuals. The “gold card” would provide permanent residency status and the ability to live and work in the United States indefinitely. The main selling point of this scheme is the exclusivity attached to it. At $5 million per visa, the card is being marketed as a premium gateway to America, meant to attract the world’s financial elite.

Trump has positioned the gold card visa as a potential economic game-changer, claiming that if just one million billionaires or multimillionaires were to buy into the programme, it could inject $5 trillion into the U.S. economy. This, in his view, could significantly contribute to reducing the national debt and boosting economic stability.

Billionaires Are Not Interested

Despite the promising financial projections, the billionaire community has largely dismissed the idea. According to Forbes, which surveyed 18 billionaires across various continents, 13 explicitly rejected the offer, three remained undecided, and only two were seriously considering it. This overwhelming lack of enthusiasm suggests that even with financial incentives, the ultra-wealthy do not see the appeal of purchasing residency in the United States.

Many billionaires already have existing residency or citizenship in multiple countries, granting them global mobility without the need for such a programme. For those who conduct international business, a U.S. residency card offers little additional benefit, especially considering the taxation implications that come with it.

Why Billionaires Are Saying No to the Gold Card Visa

Several key factors explain the lack of interest in Trump’s proposal. Firstly, the U.S. is already an accessible destination for the wealthy through various investor visa schemes, such as the EB-5 visa, which requires a much lower investment amount and still grants a pathway to permanent residency. Compared to the EB-5, which demands an investment of $900,000 to $1.8 million, the $5 million gold card visa is a costly alternative.

Another major deterrent is U.S. tax laws. The U.S. imposes taxes on worldwide income for its residents, which means that a billionaire holding a gold card would be subject to American taxation on all their earnings, regardless of where they are generated. Trump has stated that gold card holders “won’t have to pay any tax on income outside of the United States,” but such exemptions would require congressional approval and could face significant legal and political challenges.

Furthermore, many billionaires prefer to maintain their existing citizenship and residency due to business and political considerations. Some fear that obtaining U.S. residency could complicate their financial and legal structures, particularly when dealing with international trade, asset management, and inheritance laws.

Indian Billionaires Show No Interest

Among those surveyed, seven Indian billionaires expressed a unanimous lack of interest in Trump’s gold card visa. One of the most notable responses came from Abhay Soi, chairman of one of India’s largest listed hospital chains, who dismissed the offer outright. Like many other wealthy Indian entrepreneurs, Soi prefers to retain his Indian citizenship and focus on business growth within the country rather than seek alternative residency in the United States.

The reluctance of Indian billionaires is also tied to India’s strengthening economy and expanding global influence. For many high-net-worth individuals in India, international business opportunities are no longer exclusively tied to the West. Economic power has become more decentralised, allowing business leaders to operate successfully without needing a U.S. residency.

Taxation Concerns: A Major Stumbling Block

One of the primary concerns for billionaires considering the gold card visa is taxation. Under current U.S. tax laws, permanent residents are required to pay taxes on their global income. This presents a significant financial burden for individuals who generate most of their wealth outside of the United States.

Trump’s claim that gold card holders would be exempt from foreign income taxes raises legal and logistical questions. Such a policy shift would require legislative approval and could face opposition from Congress, particularly from those concerned about tax fairness and revenue implications.

If the tax exemption is not passed into law, billionaires who opt for the gold card could end up paying significantly more in taxes than they currently do, making the proposition financially unattractive.

Existing U.S. Residency Options for the Wealthy

For those seeking U.S. residency, there are already established routes that do not carry the same level of financial commitment. The EB-5 investor visa programme has long been a preferred choice for wealthy individuals, offering a path to a green card in exchange for investing in job-creating businesses in the United States. This programme requires a minimum investment of $900,000 in a high-unemployment area or $1.8 million in other regions.

Unlike the gold card, which is positioned as a luxury residency pass, the EB-5 programme provides a more structured pathway for investors who want to contribute to the U.S. economy through direct investment and job creation.

Other options include E-2 investor visas and L-1 intracompany transfer visas, which allow foreign business owners and executives to establish or expand their operations in the U.S. without the need for such a hefty upfront payment.

Is Trump’s Gold Card Visa Doomed to Fail?

The tepid response from billionaires suggests that Trump’s gold card visa is unlikely to generate the expected financial windfall. The assumption that the world’s wealthiest individuals would be eager to pay $5 million for U.S. residency appears to be a miscalculation. Many already have access to the country through existing visa schemes, while others prefer to maintain their financial independence without taking on the tax burdens associated with U.S. residency.

Trump’s idea, while bold, faces significant practical hurdles. Without a clear tax exemption law, the financial benefits of the gold card remain questionable. Moreover, many billionaires already enjoy global mobility through other means, making the offer redundant.

A Limited Market for the Gold Card

While the billionaire class may not be interested, there could still be a niche market for this visa among ultra-high-net-worth individuals who see value in securing U.S. residency as a status symbol or a long-term financial security measure. Some wealthy individuals from politically unstable regions may consider it as a safeguard against economic or political uncertainty in their home countries.

However, whether this niche market is large enough to make the programme a success remains doubtful. Unless the U.S. government introduces additional incentives, such as guaranteed tax exemptions or business advantages, the gold card visa is unlikely to attract the level of interest Trump envisions.

Final Thoughts on the Gold Card Proposal

The gold card visa highlights the challenges of monetising residency as a revenue-generating tool. While the concept of selling residency to the wealthy is not new, its success depends on the perceived value of the offer. For many billionaires, the benefits of a U.S. residency simply do not outweigh the financial and tax implications that come with it.

Trump’s proposal may spark discussions on alternative ways to attract high-net-worth individuals to the U.S., but in its current form, the gold card visa seems unlikely to become a significant economic driver.